0 Goods & Services Tax (“GST”) GST Implementation: A Practical Viewpoint Renuka Bhupalan Managing Director Taxand Malaysia. - ppt download

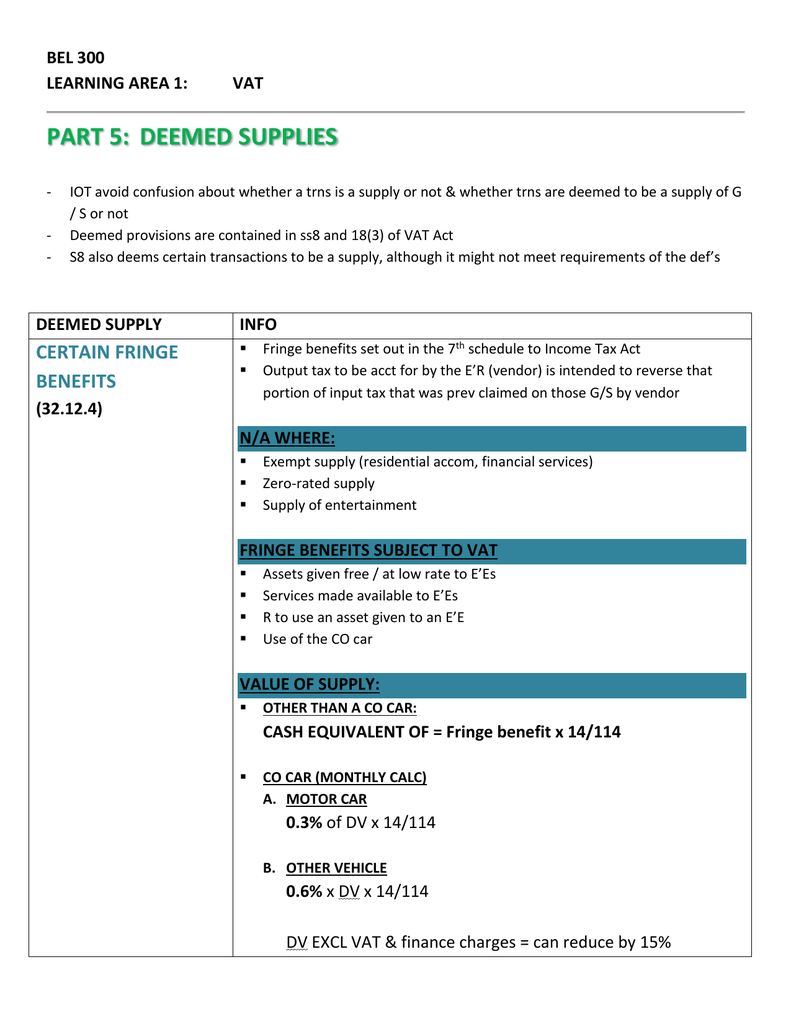

Schedule 1 - GST || Deemed Supply || Supply Under GST || CA IPCC/Inter/Final || Simple and Short - YouTube

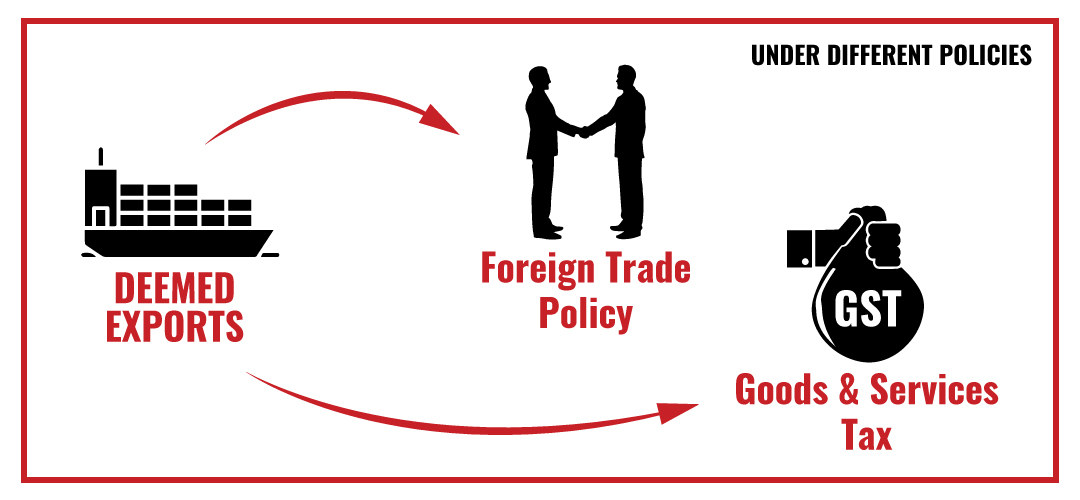

Manufacturing, Made in India : Deemed Exports, how to reap benefits of supply chain taxation schemes. | Bizbrains Advisors is an expert consulting firm that serves as the complete solution to all

We Are Open: Superior Industrial Supply is Deemed Essential Infrastructure Support - Superior Industrial Supply | Blog | Hose, Accessories, Fasteners, Industrial Supplies in St. Louis Region

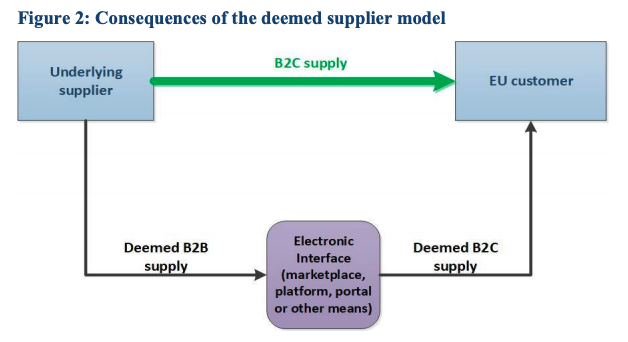

%20Deemed%20Supply%20by%20Principal.png)